The Evidence Ecosystem: Where PMs get their ideas from

6+ Ways Products Help Users Make Decisions

In this edition of Behind Product Lines, we’re covering two topics:

A Product Manager’s Evidence Ecosystem: how info travels to a PM

How Products can help customers make better decisions.

How Ideas Travel to a PM through an Evidence Ecosystem

Product Managers constantly swim in an ocean of evidence.

PMs need evidence to make informed decisions, prioritize, build strategies & devise solutions.

Evidence comes in different shapes & forms. This can be data from an analytics software, results from a customer interview, qualitative feedback, a market trend or even an anecdote.

The graphic below shows how evidence evidence travels through to a PM.

There are 11 sources where Product Managers gather their intel from:

Customer/Prospects share their problems, aspirations & ideas.

Sales work with customers to surface customization requests & objections.

Customer Success share business review feedback & feature wishlists.

Customer Support file support tickets & escalates high-priority issues.

PMs work with Marketing to retrieve demand trends, ICP research, interview feedback.

PMs tap into Market Intel to capture macro trends, third party reviews & competitive inf.

Product Analytics & dashboards inform PMs about the health of the product from adoption to retention.

External forces like partners, suppliers & government share important intel on processes, market shifts & new regulations.

The Community contributes to a PM’s idea bucket with feature suggestions & discussions.

A PM learns a lot through dogfooding the product.

A PM can learn a lot from structured user research e.g. focus groups, surveys & other methods.

Typically, there are two primary paths for evidence:

👉 In some cases, Product Managers PULL evidence from a source. For example, PMs may conduct regular discovery cycles, analyze product metrics, conduct interviews, carry out surveys/experiments etc. to proactively gather clues about the job-to-be-done.

👉 In other cases, evidence is PUSHED to a Product Manager. For example, sales teams share objections or customization requests, customer success conveys product feedback/wishlists & customer support escalates common problems users are facing.

🚫 Let's pause here for a moment.

With so many conduits of information leading back to the PM, let's appreciate how HARD it can get for a PM to deal with this. It's a tedious challenge to distill all those inputs to decide what to do next.

This challenge only becomes bigger as PMs try to maintain some sort of balance between PULL and PUSH evidence paths.

In most product cultures, one supersedes the other (usually it's push >> pull) and that can lead to a myopic view of the ground reality.

Why?

🚩When PUSH inputs are disproportionately larger than PULL inputs >

🔹Product teams become overly reactive & opportunistic.

🔹It's difficult to plan strategies for the future.

🔹PMs lose all their time to firefighting.

🚩And when no PUSH inputs are coming in & it's all PULL >

🔹Customers either aren't invested enough in the product to issue feedback to customer-facing teams.

🔹support teams are blocking off feedback loops creating blind spots for PMs.

🔹Customer fires keep burning, resulting into eventual churn.

What kind of evidence pools do you tap into?

How Products Help Users Make Decisions

Great products equip users with the tools to make sound decisions.

According to Sheena lyengar’s "The Art of Choosing", customers 'flee' when confronted with a myriad of choices.

They enter a stalemate of sorts which gives rise to anxiety. Putting users into a state of indecision in your product poisons user activation & retention.

That's why boasting a vast inventory of listings isn't enough to guarantee the traction you're looking for. Now, of course, making choices isn't always a rational process. People are affected by biases. There are several documented types like bandwagon effect (what others are doing), loss aversion & confirmation bias (seeking out info you already believe).

So, what do products do to help users manage choice?

👉 One baseline technique is categorization. Categories create choice silos.

Ex: Audible: rather than reviewing a flat list of 500 titles, users first choose a category like business or tech to pick out an audiobook.

👉 Another technique is whittling down the supply to reduce choice.

Ex: When Proctor & Gamble reduced the SKUs for their Head & Shoulders shampoo line from 26 to 15 products, sales lifted by 10%.

Here are some other approaches products use:

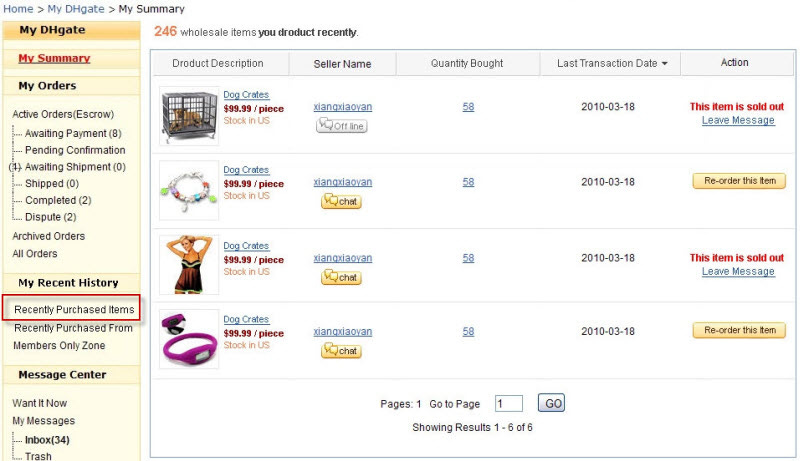

𝟭. 𝗦𝘂𝗿𝗳𝗮𝗰𝗲 𝗣𝗮𝘀𝘁 𝗖𝗵𝗼𝗶𝗰𝗲𝘀

"What did you use before?"

Products surface decisions taken in the past to short-circuit the process. Ex: Instacart frontloads all the items you've bought in the past to ease re-orders.

𝟮. 𝗘𝘅𝗽𝗹𝗼𝗿𝗲 𝗣𝗿𝗼𝘅𝗶𝗺𝗶𝘁𝘆

"What are things that look like what you opted for before?"

Products use ML to suggest potential choices based on past behavior & similarities.

Ex: Spotify & Netflix push out recommendations based on what you've listened to or watched before.

𝟯. 𝗦𝗼𝗰𝗶𝗮𝗹 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀

"What did similar people use before?"

Ex: Amazon tells you what other people who bought an item your purchased bought along with it OR Zomato surfaces reviews & social recommendations to encourage a purchase.

𝟰. 𝗛𝗶𝗴𝗵𝗹𝗶𝗴𝗵𝘁 𝗟𝗼𝘀𝘀 𝗔𝘃𝗲𝗿𝘀𝗶𝗼𝗻

"This is popular & might go away soon."

Ex: Booking.com highlights how a listing has a great price but also how many people are looking at a listing encouraging them to act fast.

𝟱. 𝗗𝗶𝗮𝗴𝗻𝗼𝘀𝘁𝗶𝗰𝘀

"What is your buying criteria? What are your dealbreakers?"

Offering contextual faceted search or a deep survey wizard to fetch viable options.

Ex: Airbnb offers several search options on their facets to get you to destinations you'll like. OR Noom uses long surveys to recommend exercise plans.

𝟲. 𝗖𝗼𝗺𝗽𝗮𝗿𝗶𝘀𝗼𝗻𝘀

"How does this offer compare with others?"

Ex: Autotrader & Truecar guide users on whether a listing is too pricey or just right to "aid" your decision to buy. Above all, learn how users of your product make their decisions. Figure out the factors they look at, the people they ask & the research they do. "Choice navigation" can well be a product differentiator.