In this edition of Product Behind Lines, we will dive deep into one of the most mysterious metrics that PMs tackle: churn.

Every product suffers a bit of the “leaky bucket” effect. However, a common problem I see is that Product Managers track that as merely a “number” and don’t go the extra mile to unpack & understand it.

Knowing why a customer packs up and leaves is critical to bring a new product towards Product-Market Fit and protect an established product from veering off it.

Let’s learn a bit more about churn.

Types of Churn Metrics

At a high level, we have two churn metrics that businesses typically keep care about.

1. Logo Churn

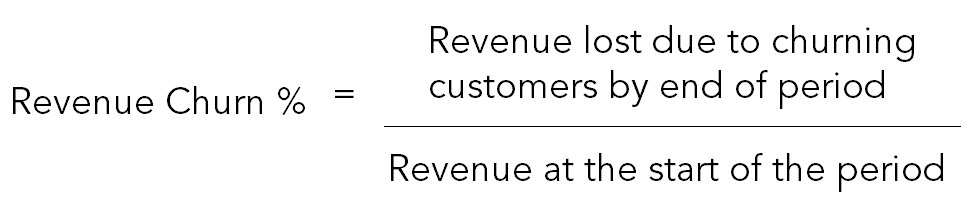

2. Revenue Churn

Logo churn pertains to the rate at which you lose customers over time.

Ex: You had 10 customers at the beginning of the month. 2 bail out at the end. Your logo churn comes out to be 20% for that month.

Revenue churn refers to the rate at which you lose revenue (typically monthly recurring revenue) as a result of those customers leaving.

Ex: Say, you earned $1 Million last month with 10 customers. 2 of those that contributed $10,000 in total leave you this month. Your revenue churn would be 1%.

Great, so which one do you need to pay attention to?

Simple: Both.

Each provides valuable context for the other.

For example, you can have low logo churn but exceptionally high revenue churn because you just lost a couple of clients that contributed to most of your revenue. This shows high dependency on a few big contracts and the dire need to diversify your portfolio.

Similarly, you can have high customer churn but low revenue churn which indicates that a lesser lucrative segment (say SMB) exits frequently without maturing and thus, warrants scrutiny.

Now, that we have the metrics out of the way, let’s look at a process of addressing churn on a regular basis.

Churn Evaluation Process

Step 1 — Track Churn Metrics

You can’t have a debate on numbers that you aren’t tracking, can you?

Luckily, most product teams are able to report on monthly revenue and logo churn metrics fairly easily as they just need to keep tabs on customer & revenue figures over time. A simple query on the product’s database or reports from the finance/accounting team will also make this data point evident.

In case you need a tool to monitor this regularly, then using a subscription analytics platform like Chartmogul will help.

2. Understand the driving forces behind churn

The second part is which needs a bit more detective work and diligence: unpacking driving forces.

It’s critical to find why a certain account chose to churn because not all churn is the same and each has to be battled in different ways.

In certain cases, you’ll see that the churn event itself wasn’t necessarily a “ball-drop” but nevertheless, contained valuable feedback that should be looped back to other teams.

As these accounts exit, someone needs to find out the reason and add an appropriate tag on the CRM for analysis later on.

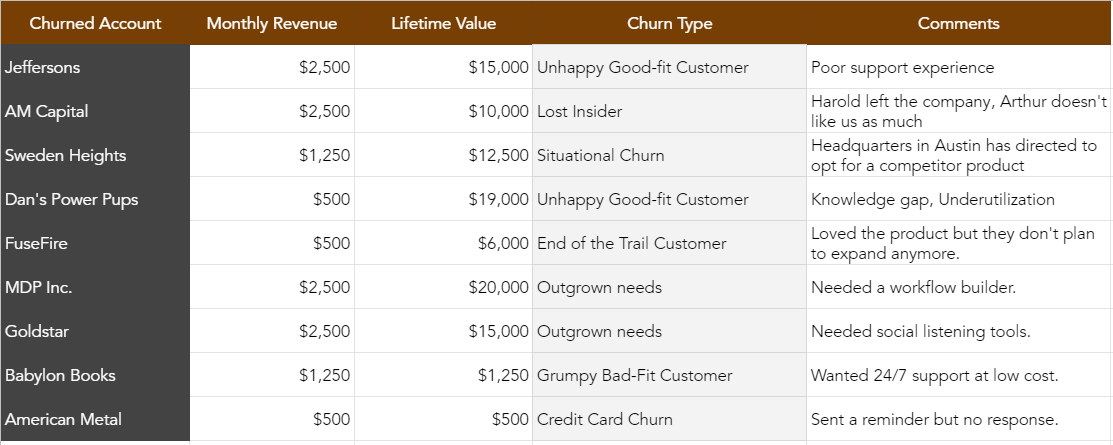

This is what the report might look like when you start having your discussion:

Next, let’s look at the typical driving forces behind churn and the reasons in the fourth column above.

a) Unhappy Good-fit Customer

This is the one that hurts the most.

When a customer that the product was meant for leaves the fold, it’s a time for hardcore introspection.

In my time at Talentera, I found a few sub-reasons behind this occurrence:

Poor Onboarding: the customer was never properly trained, oriented & welcomed to the platform which left them to figure out the solution.

Switched hands: the initial set of users were all set on the solution but then there were a few replacements who were used to other tools and never made the transition gracefully.

Knowledge Gap: the client simply wasn’t aware of all the problems you can solve for them and graduates to a solution that is perceived to be superior. I remember once we were about to lose an enterprise-grade client with an annual contract value of $30,000. When the CEO interviewed the decision maker in their final days, we discovered they were cancelling because they “thought” we didn’t have a couple of search features (which we did but weren’t really advertised well on the solution). An intense yet candid training later, we saved the account.

Poor Practice Usage: the customer uses the account but not in the way it’s meant to be used and thus, ends up frustrated. For example, instead of saving a job description template, a customer continues to copy paste JDs from a Word file requiring a lot of re-formatting & clean up.

b) Grumpy Bad-fit Customer

Not every customer is an ideal fit for your product.

In fact, some might be highly vocal about their unique needs which keep pulling you off on another tangent that you’re not meant to serve.

Such customers keep voicing their concerns and when product teams are unable to service them with a “red carpet” treatment, they head for the door.

Now, this type of churn isn’t all the bad. In fact, it’s bad weight off your and your customer support’s shoulders.

Moreover, it helps in identifying the traits of the customers you want to serve and feedback on such accounts must be cycled back to marketing (to improve their targeting) and sales (to bolster their vetting process).

c) “End of the trail” Customer

It’s very possible that the customer happily achieves what they wanted from your product and then decides to leave since the need no longer exists.

For example, a few years ago I was helping a few friends develop some professional looking resumes. I suggested them to sign up for Enhancv to build a few versions out. A few months later, they landed the jobs they wanted. Thus, there was no need to keep paying a monthly for a resume service, so they discontinued.

Again, there isn’t much you can do in such cases, however, if someone did have a positive experience, you definitely want them to generate a strong referral for you and you need to keep them in your subscription list for future opportunities.

d) Credit Card Churn

The problem is straightforward: The credit card on file is expired or has insufficient funds and thus, blocks you from charging your subscription fee.

The obvious plan of action would be to remind them to add a valid card.

Well, that could certainly work. However, when you highlight a failed payment, it also triggers a need in the customer’s mind to re-evaluate their subscription.

Timing is key here.

If you notice utilization is dropping before an upcoming payment charge, that’s a signal of poor intent already and you need to address that proactively.

Prevention is better than cure.

The last thing you want is the customer to conclude that they were able to live without your product just fine for a certain amount of time, so “do I really need this?”. Once that thought takes flight, it’s a steep uphill climb to convince them to reach for their wallets.

e) Situational Churn

In the B2B world, a number of company-level changes can occur which can negatively affect their relationship with your product. These, too, are beyond your control.

For example, I’ve seen businesses:

Undergo bankruptcy

Get acquired where the parent company mandated another product

Witness a change of leadership that decided to go another way

I remember a few cases where we were serving the local arm of a multi-national company for years. However, they decided to cancel when their headquarters announced they wanted to use a single product (a larger competitor) at a global level.

f) Outgrown Needs

As customers grow, so do their needs.

Your product may have served your customer’s needs of yesteryear perfectly well. However, with growing scale, maturity & process complexity, their needs may outgrow what your product can offer today.

In our early years in Talentera (applicant tracking system), we used to lose a few accounts every year because they needed one ecosystem that also dealt with employee onboarding. Our onboarding story was a bit thin at the time, thus, our only strategy was to convince them on integrations where we could send hired employee data to an external onboarding platform.

Years later, we plugged off this churn avenue when we launched AfterHire — our own employee onboarding solution.

The important action points here are:

continue to understand the needs of your high-value customers and how they evolve. If you plan to expand your offering, you’ll need those insights to build the right solution. At the time of conceiving AfterHire, we had the benefit of a rich Google Drive folder brim with past RFPs that we had received from customers that fueled most of our product decisions.

explore partnerships and see if you can build native integrations with such specialized platforms where your customer simply has to plug n play another service rather than abandon yours.

g) Lost Insider

This refers to the case where you won a contract primarily due to a loyal champion within the organization’s ranks that kept on vouching for you. However, when that champion graduates to a different role or moves on, the tide isn’t that favorable anymore and their replacement authority chooses to, well, replace you.

While soliciting assistance of an insider is fair game for winning a contract, sales & customer success representatives must ensure they create deeper, amicable relationships with other decision makers in the organization over time as well.

For example, I used to a lead a classifieds product once where we had a recurring banner advertising contract with a local bank. Our business development manager was best buddies with the point of contact there. However, when our own BDM resigned, the relationship was lost and the bank revoked the contract the month after without warning.

The entire transaction was sadly built up on one relationship. It was churn waiting to happen.

3. Discuss next action steps

Now, that you have created structures to track metrics and identify driving forces behind churned accounts, it’s important to democratize that information with the right people.

Ideally, a monthly meeting needs to be called with departmental heads like leadership, customer success, support, sales, marketing & product.

This should be a retrospective of sorts. The main activities should be:

Compare the churn metrics against last month and the prior year.

Share the breakup of driving forces and why accounts were churning the most.

Enrich the context of churned accounts with additional information shared by various teams (they may know a bit more than what’s tagged)

Decide on action points (related to product, process & people) on how to best address these challenges in the future.

Planning Churn Blockers

Different constituents of the product team have their own theories of how to reduce churn:

Product Managers will suggest more features that need to built to amplify the value of the product.

Engineers will talk about focusing on improving existing feature sets & tackling tech debt for faster delivery.

Marketing will propose to run ambitious and creative customer marketing campaigns to keep re-instilling belief in the product.

Design will think about UX areas we need to improve and why simplicity is key.

I’m not saying any of this is wrong. In fact, the reality might be that at some level, all of this might be required.

If the customer has issues with the product, then yes — this will require an improvement in the feature set, design and engineering velocity.

However, this ideation process always needs to start from the customer, not from the team.

First of all, ensure you setup a no-pressure exit interview with the churned customer (along with a survey) to understand grievances or shortcomings in the product objectively.

Moreover, you’ll find that customer success (teams that manage the relationships with these accounts) will have the most insights on why a customer chooses to leave. Get them to de-brief the larger think tank.

Now a note for Product Managers specifically: churn isn’t necessarily solved by launching a new feature or workflow. It’s often best deflected by strengthening the relationship you have with the customer and ensuring they are being heard.

I’ve worked in several products that perhaps, in the face of competition, lacked in certain technical areas. However, giving that personal, loving attention to each customer, genuinely understanding their concerns and partnering with them on their journey helped us retain them far more than a rollout of a flamboyant feature.

Moreover, product, sales and customer success team need to work hand-in-hand to build the right strategy to serve customers in the best possible manner.

There are far too many fundamental mistakes made in this respect:

Force-feeding features rather than taking a consultative approach. It’s critical to keep understanding what the core problem the customer is trying to solve and then meaningfully mapping that to a product feature that you serve. Get out of always selling. Start solving.

Not understand the customer’s situational context. It’s critical to build deeper relationships with multiple people in the organization (especially your point of contact’s direct supervisor), learn about the user’s life at the office, who they are trying to impress and the social interactions within it. Become their extended team member, not an emotionally-aloof provider.

Not exploring cross-selling or up-selling opportunities. This stems from the second point. Your customers are trying to solve multiple problems at a time. If you can take care of the primary one pretty well and then raise your hand for a few others that your product can potentially solve, they will love you for that. Most reps don’t even ask or have the curiosity (or audacity) to learn more. It’s only a matter of time when someone else might choose to take on that mantle.

If you follow the process laid out on a regular basis and then continue to land and expand through upsells/cross-sells, you can potentially land into the highly coveted arena of net negative churn.

Net Negative Churn

Consistent net negative churn is a candy land for SaaS ventures (with one caveat which I’ll explain in the end).

It basically means that although you might be incurring revenue churn on a monthly basis, the companies that stick with you extend their spend such that it not only covers the loss you incurred from churn but it adds on top of it.

For example, let’s say you had 100 customers at the end of a month, each paying you $1. Your MRR is $100.

The next month, you lose 5 of these customers. That’s 5% revenue churn. Boo hoo.

However, 50 of the 95 accounts that stuck with you choose to expand their subscription to the $2 tier.

That means your revenue shot up to $145 translating to a mammoth -45% negative churn. Amazing!

Now, what’s the caveat?

Well, you can still incur negative churn due to one account choosing to award you a gigantic contract. This lands you back into the same issue of a lop-sided portfolio where you are prone to low logo churn & high revenue churn in the future.

Ideally, as a Product Manager, you want negative churn to come as a result of multiple customers choosing to give you a larger share of wallet. The way you can achieve that is having standardized customer success and support processes that impress your clientele consistently across the board.

The secret sauce of success of vFairs (a product where I lead growth) has been the uncanny ability to deliver stellar value to the customer in the first year in a way that it balloons to anywhere between 1.5x-4x it’s size the following year.

Conclusion

Listen, acquisition is a tough game. Getting a new customer to sign up requires a lot of effort from a number of parties. However, while retention of an existing customer base isn’t trivial either, it’s something that’s far more in your control.

And remember: if you understand why customers churn, you can potentially acquire far more users by offsetting those concerns proactively.

Finally, blocking churn doesn’t mean launching a new feature. Far too many times, I see Product Managers compiling a bouquet of features that they think will make customers stay.

Humans are emotional beings. Talking to your customer and understanding the underlying motives behind their decisions will show you that sometimes all that’s needed is a candid, caring conversation.