Most people seem to agree “network effects” are a desirable trait for products like social networks & marketplaces.

Yet, “network effects” are elusive & mysterious - they aren’t a tactic, a playbook or a framework.

The best you can do is to develop a strategy that positions the product to benefit from them.

It’s important to understand that while network effects are a strong moat for a product, they aren’t an iron-clad protection.

Example: Snapchat was creating havoc in the social network world in 2015 & enjoying network effects as a younger demographic pooled in. However, Instagram launched their version of stories & zoomed past their DAUs in 2017.

Image Source: Recode

Products like these that enjoy immense “network effects” seem like they’re unassailable…until an incumbent like Tiktok gets into the ring.

This means, as a Product Manager in a highly competitive market, there are a few tricks you can explore to give the status quo a run for their money.

But let’s start from the basics.

What are Network Effects?

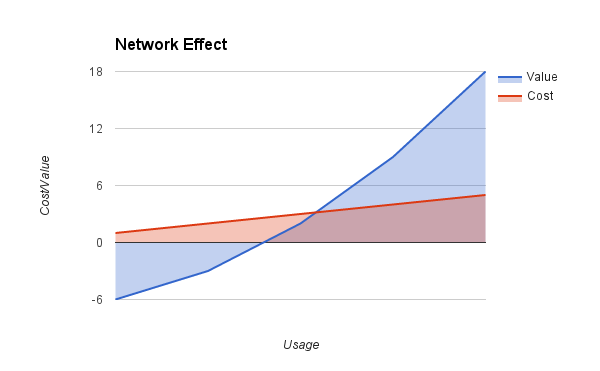

Quick definition:

It’s a concept the value of a product or service increases when the number of people who use that product or service increases.

Interestingly, some industry voices have a slightly a different definition.

They claim that the product or service value rises when the usage of the product increases, not just the count of users. This is like saying that the value of the product rises with active users.

Image Credit: Org Hacking

What kind of products exhibit network effects?

There are three popular product categories:

Networks like LinkedIn, Facebook or Instagram. The more connections you have, the more value the network represents.

Platforms like Android or Windows. The more users join the platform, the more the perceived value for engineers developing apps for that platform and vice versa.

2-way Marketplaces like Amazon, eBay or Uber. The more sellers selling a variegated inventory, the more value (choice, stock, short pick-up time etc.) it represents for buyers.

When do Network Effects start failing?

Next, let’s explore why an established players may start stagnating as they scale bigger. These are opportunities where smaller incumbents can jam a foot in the door & start eating away a piece of the pie.

Poor Quality of users

New user cohorts may bring in low quality engagement or inactivity that lowers the experience of existing users forcing them to flee.

Example:

Orkut, the popular social network in the mid-2000s, crumbled due to overpopulation. The privacy & verification layer was thin (compared to alternatives like Facebook) which made it easy for stalkers & bogus people to indulge in mischief.

Poor Quality of content/supply

Network effects also start failing when incoming content supply becomes irrelevant or harmful to the existing user base.

Example 1:Craigslist faced this when fake ads started popping up allowing players like Airbnb to claim a stake on the rental marketplace.

Example 2:

The quality of answers and questions on Yahoo answers started declining rapidly which gave way for Quora to capitalize.

Behold:

Low signal-to-noise ratio

The central piece of every social network is the feed. Similarly, in marketplaces, the recommendations algorithm is a key part of the user’s personalization experience. If that gets polluted, things start going downhill.

Example:

If a professional on LinkedIn starts accepting all kinds of combinations, their feed will get polluted with irrelevant content fairly fast.

On the same lines, if a job marketplace gets flooded with a small pool of job types, then job recommendations to job seekers will lose efficacy.Value Plateau

This pertains to a scenario when the addition of new users/providers stop adding further value to the platform.

Example:

In the ride hailing market, riders want fast pickups & drivers want a healthy stream of orders. Now, once riders are getting average pickup times of under 3 minutes and drivers have a full workload, the marketplace becomes saturated. This means adding more drivers or users won’t really bump up the value.

What are ways new products can challenge established ones enjoying Network Effects?

Some tactics products use to cut open such markets:

1. Favorable Pricing

Cut the competitor on price tags or come up with a far more appealing cost structure.

Ex: Ebay's EachNet was an e-commerce marketplace that used to charge commissions on it's sellers. Taobao came in as a new player & didn't charge sellers. Instead, they monetized with ads. 3 years later, Taobao overtook EachNet's share.

2. Supply quality

In marketplaces, focus on generating a diverse inventory and double down on it’s accuracy & integrity.

In networks, this means qualifying users as they join and moderating content to maintain high signal-to-noise ratio.

Ex: Fake ads on Craigslist hurt them & allowed players like Airbnb to grow in the rental marketplace.

3. Bringing "validation"

Establishing trust by bringing brands & influencers that people trust can turn heads.

Ex: Yahoo Answers was marred with poor content. Quora did a better job not just with better moderation but also bringing experts with solid credentials (actual CEOs, founders, thought leaders) to answer questions.

Ex 2: Snack Video gained initial traction by incentivizing Youtube and TikTok stars to come on board to fuel growth.

4. Wedging your product with multi-homing

Multi-homing is a situation where users or sellers are using multiple competing apps e.g. Uber & Careem. New products can exploit situations where established players don't have exclusive lock-ins with suppliers.

Ex: Apart from an attractive business model, InDriver was able to convince drivers to use their app alongside Uber/Careem & objectively compare experiences in both.

5. Capturing a niche

Solve a problem for a subset of the competitor's users in a more compelling manner.

Ex: Twitch targeted the gaming community & served that niche better than Youtube.

6. Delivering differentiated value

Research users in the existing player's market & target an unfulfilled need.

Ex: TikTok understood the demographic of young teens with short attention spans. They had already captured the China market and after the acquisition of Musical.ly, they landed on a highly snackable form of entertainment with short video that newer generations swallowed whole. They also enabled these masses to become creators & earn with a regular smartphone, something that wasn’t that straightforward with Youtube. In fact, many users now answer their search queries through TikTok because of their stellar search/recommendation system.

What if you’re an established player trying to fend off new competition?

What if you’re ahead in the game and need to maintain your market leadership? Here are some defensive tactics established players use.

Leverage Data.

Products with network effects generate data fairly quickly. That allows them to provide recommendation services that new entrants can’t compete with overnight.

Example:

Amazon’s recommendation system around what other people bought is a strong differentiator.Prevent multi-homing.

Marketplaces try to figure out how they can prevent users from using multiple products of the same category (continued usage can segue into price wars which creates a lose-lose scenario). They do this by some incentive or exclusivity angle.

Example:

Amazon Prime provides fast next-day delivery along with other benefits which makes it hard to give up. Similarly, XBox offers exclusive titles on their platform which increases stickiness.Counter effects of overpopulation.

Create automated processes to process spam, clean up feeds & maintain content hygiene. Or create structures that allow users to personalize and control what they see in their feeds.

Example: Quora employs AI-based moderation bots that collapse comments and manage answers automatically, thus, improving the feed quality.

Example 2: One can’t message anyone on LinkedIn - they need to be connected with the person in question. (unless they purchase Inmails)Retain brands.

Keeping your brands, celebrities & influencers on your platform can pose a barrier to exit for other users. Users yearn for trust and will gravitate towards where they find that.

Example: Twitter started giving out “blue tick” to verified personnel which is now regarded as a status symbol that’s hard to forego.

Conclusion

Network effects are a desirable trait for most products, however, their effects can quickly reverse if challenges of scale aren’t addressed.

Classic PM Mistake: Optimizing one product metric at the expense of another.

To illustrate this, think of an extension wire.

You know how there are certain chargers with ungainly-sized plug heads that don't play nice with other slots on the wire?

As soon as you force one into an extension slot, it unhinges the plug next to it.

And you're simply not able to find an angle which will accommodate both plugs together at one time.

A similar problem arises in product metrics a lot.

You try to optimize for a certain metric and become so obsessed about it that you lose sight of another key metric that's taking a nosedive.

Example #1

Product = recruitment software. I was trying to reduce the time it takes to post a job to enable a quicker time-to-value for new users.

The team theorized that a shorter job posting flow would help in reducing friction.

We rolled a lightweight version & it was an instant hit. Result? We increased our job posting counts by 2.6x in a week's time.

But something was wrong.

We realized that the job post quality - the score we assign to determine how well the job description is written - also tanked. job post quality has a direct impact on job seeker application counts.

We managed to simplify the job posting flow, but that translated to "thin" & generic job descriptions that weren't compelling enough.

Example #2

I was trying to open up the top-of-the-funnel by landing more traffic on the vFairs marketing site by "renting" paid & social traffic.

However, while pageviews started booming, the lead quality dropped sharply.

Example #3

In early 2010s, Airbnb was rolling out features in an attempt to optimize for the number of nights booked.

However, this aggressive shipping velocity left defects in the platform that translated to an undesirable 30% increase in customer support tickets.

Example #4

Facebook loaded the initial versions of their mobile apps with tons of features. However, due to the lack of optimization measures, the app's loading time was annoyingly high.

Bear in mind: the goal isn't to eliminate metric dependencies. That might be out of your hand. As a PM, you'll need to decide how much loss/deficit you're willing to bear on one metric by optimizing another.

For each feature you're building,

1. Outline primary and secondary KPIs that you're setting out to improve.

2. With that, identify "contra-indicators" which you do not want to sacrifice as metrics in (1) are improving.

3. Set thresholds for (2) to help you identify when an experiment isn't working out. This keeps you honest in your optimization efforts.