The Practical Guide to Competitive Research for Product & GTM Teams

In today's edition, we break down all the channels, tools, and processes PMs and PMMs can tap into to gather actionable competitive intel.

I'm not a big fan of the following advice:

"Ignore the competition. Focus on customers."

It seems to be popular advice in startup land:

Yes, copying competition mindlessly is counter-productive and absurd.

However, when working in the B2B SaaS space (especially enterprise), it’s becoming almost impossible to operate effectively without knowing what the playing field is up to.

At vFairs (the event tech company I work for), we use call recording software to track sales demo calls.

What I noticed was that in roughly two of every 5 calls with high-value deals, prospects tend to ask:

"How do you compare with [competitor name]?"

We can't answer that with generic fluff. Customers are savvy and aren’t impressed with hand-waving monologues. They want hardcore specifics and sometimes want us to send them our comparison decks.

Having said that, handling sales objections isn’t the only reason for studying competition. It can help inform product strategy, messaging, positioning, and go-to-market.

Yet, many organizations reduce it to an exercise led by the “product” team to compare feature differences and ensure parity. They aren’t aware of other information channels to tap into and how that data can help different organizational functions.

That’s the topic of today’s newsletter.

This is a deep dive into:

how to shortlist competitors to research

scrappy methods and tools to use to capture competitive intel

how different team members benefit from this research

But before we go on, here’s a word from today’s sponsor, Klue:

📣 Calling all product marketers! Klue, the competitive enablement platform, is hosting a two day free conference (Oct 28-30) to learn best practices and network with your peers.

What to expect?

👉 Two days to connect with some of the best minds in the industry

👉 A packed and busy agenda that will make you a better product marketer — including hands-on talks on how to actually get sh*t done

👉 Exclusive in-person workshops

Here's a peek at some of the sessions and speakers who will be taking stage at Compete Week 2024:

🔍 The Competitive Blindspot That is Costing You Millions with Jason Smith, CEO at Klue

😈 How to Disrupt 'Safe Choice' Incumbents with Jessica Davis from HubSpot

👥 How Two Leaders Combine Win-Loss and Competitive Enablement with Dylan D'Urso from Autodesk and Claire Brunvand from SurveyMonkey

Seats are limited, so save your seat now!

Signed up for the event? Cool, let’s proceed.

Suggestion: this post is too long for email. I’d highly suggest reading it on aatir.substack.com.

Let’s start from the basics.

How do you select which competitors to research?

Here’s a classic classification of competitors from good old marketing textbooks:

Direct competitors: These are SaaS companies offering similar products or services targeting the same market segment. (ex: Clickup vs Asana)

Indirect competitors: Companies solving the same problem but with a different approach or technology. (ex: Slack vs Gmail)

Substitutes: Products solving the same problem but with a different solution category. (UberEats vs food court).

That’s all fine and dandy. But when you have many sharks in the pool, it’s hard to scan every player.

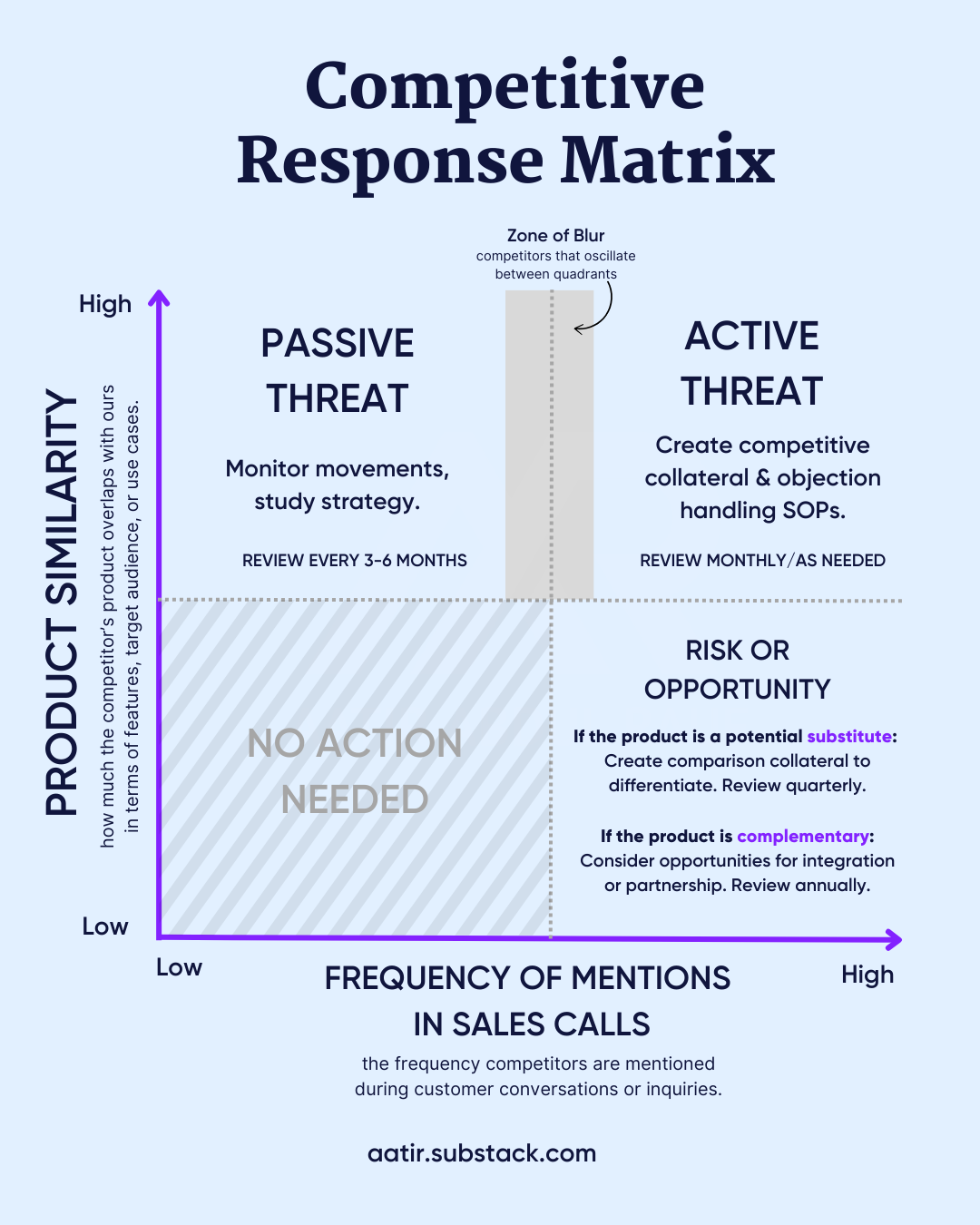

Thus, I would like to further classify direct competitors as active or passive threats.

Active means players with whom I’m constantly butting heads in several deals.

Passive means competition with a comparable product, but their market focus differs, and we aren’t losing many deals to them.

Both require a slightly different competitive response, as shown below:

If you've been in the market for a while, it’s easy to identify the active lot:

Competitor mentions in sales demo calls or win/loss analysis:

At vFairs, we use tools like Gong and Hubspot call recording to analyze the frequency of each competitor's call-out. We also ask the sales team for feedback on who they’ve been locking horns with. Those are usually the set of active threats.G2 & Gartner Reviews

Another source to tap into is competitive mentions in your third-party reviews on sites like G2 and Gartner. In fact, on Gartner, there are dedicated fields where customers mention the vendors they considered during their buying cycle:

Google SERPs presence

It’s common practice to see who ranks for high-intent keywords organically, but the active battlers will bid on our branded terms, attempting to funnel traffic away from us.

For example, here’s Demoboost throwing shade on Storylane:

So, when shortlisting, start with active threats.

But if you’re just starting with your product, you probably need to create a wider list using these tools:

high ranking in Google SERPs for majority of high-intent keywords

G2 and Capterra comparison grids

LinkedIn company pages of companies offering the same product

SaaS companies in your space on Crunchbase

Industry reports like Gartner, Forrester, and IDC

Social media mentions in hashtags of interest

Quora and Reddit (on category-relevant questions)

How many competitors should you go after?

If you’re starting, pick 3 with the closest affinity to your market. Then, expand as you see more activity.

Eventually, you need to be prepared for all your active threats as even a few percentage points increase in win rates there can make the research exercise worthwhile.

Just know that as you grow your product footprint, you’ll naturally have to contend with more products, especially ones that might be subsets of your offer. They are smaller players specializing in only parts of the solution canvas you provide.

Ok, so we have our shortlist.

What are the channels, tools, and methods one can leverage to capture competitive insights? Ones that are actually useful.

Let me start with a little cheat sheet to give you the high-level overview.

Now, let’s look into the competitive aspects to explore:

Organization Profile

What to gather: Funding history, customers they serve, employee growth rate, office locations, leadership changes, acquisitions, job openings, department growth, types of roles, location of hires.

Where to look:

Use Crunchbase Pro for funding data

Check LinkedIn for employee count tracking

Set Google Alerts for news

How it helps:

It helps one understand a competitor’s strategy at a company level, their target market, their expansion plans, and resource allocation.

Looking at their trophy customers also helps you understand the kind of accounts they can handle and potentially new industries/markets you could break into.

It gives a sense of what markets they are penetrating into and if they are investing in one’s own space (marketing, sales, or talent-wise).

For example, when Notion acquired Aquarium (AI search and retrieval) and Skiff (secure collaboration) in 2024, it signaled its strategy to competitors like Clickup and Evernote that it’s planning to position itself as an enterprise-ready, AI-powered workspace rather than just a note-taking tool.

Product Capabilities & Strategy

What to gather: Product scope, feature releases, changelog, API documentation, tech stack, integration partnerships.

Where to look for this:

Browse their marketing website

Take free trials and record Loom videos of feature exploration

Look at their documentation and knowledge base

Subscribe to their changelog/updates

Track their integration marketplace

Watch YouTube demo videos for feature demonstrations

In some cases, purchase competitor subscriptions through partners

Join community forums to scan feature discussions

See if they have a public roadmap

For example, here’s Buffer’s public roadmap:

Why it helps: This information helps PMs and PMMs determine the delta between different products, expand their minds on different problems that can be solved, and also tee them up to create a differentiation narrative.

Disclaimer: Most publicly available roadmaps show the “10% incremental value items” the company is working on. Their 10X big bets are hardly represented there. Be wary of that.For example, Miro's rapid release of AI features with its latest innovation workspace puts pressure on Lucidspark and Mural to figure out their new identity in the AI era.

Search & Ads Analysis

What to gather: Keywords they target, ad copy variations, landing pages, organic ranking changes

Tools & Methods:

SEMrush for paid and organic analysis (I really like their keyword gap analysis)

Spyfu for competitor ad history

Ahrefs for backlink analysis

Why it helps: Reveals their customer acquisition strategy and target segments. It also helps optimize one’s marketing spend and gives inspiration on other keyword opportunities to bid on (or write content for).

For example, at vFairs (event tech platform), we did a keyword gap analysis to identify new event types that we were not targeting but were relevant to our product e.g. “festival apps” and “symposium platforms”.

Website Analysis

What to gather: Read their landing pages, notice design changes, messaging evolution, positioning, traffic patterns.

Tools & Methods:

Extract headlines from landing pages and analyze them with AI to understand trends.

Use Wayback Machine for historical changes.

Use SimilarWeb for traffic analysis.

Notice the CTAs, lead magnets, webinars etc. they are promoting.

I would dive deep into the copy on the website to unpack their positioning to figure out:

how they classify themselves (the category)

who their ICP is

the prime benefits they flaunt

whether they have a unique point-of-view

Why it helps: Figuring out competitive positioning allows you to fine-tune your differentiation narrative. It also gives you messaging ideas over benefits that you may not have been highlighting as effectively. Analyzing the technical aspects of the website also helps you figure out their SEO levers.

I highly advise you to check out Hubspot’s Company Research agent on Agent.ai. It can extract a lot of what I covered above with a single prompt.

Of course, the information might be very basic for the most part, but it gives you a great running start and a holistic view.

Support Analysis

What to analyze: Response times, support channels, documentation quality, SLAs, knowledge base structure

Tools or methods:

Create test accounts

Track support response times

Monitor community forums

Review help documentation

How this helps: Identifies service gaps and opportunities to differentiate. Helps benchmark your support metrics and improve customer experience.

Reputation Signals

What to gather: Review trends, rating changes, common complaints, feature requests, customer segments

Tools & Methods:

G2 review monitoring (in fact, here’s an article on how you can use AI to analyze larger data sets)

Capterra review analysis

Reddit/Quora mentions

Set up Google Alerts

Why it helps: Analyzing the reviews gets you direct customer feedback and where you lack. It also helps you understand the likes and dislikes of your competitor’s customers and where they are struggling. This data is critical for sales enablement and product prioritization.

Content Analysis

What to gather: Blog topics, content formats, guest posts, webinar themes, case studies

How to capture:

Analyze their blog

Subscribe to the newsletter

Use SparkToro for audience analysis

Attend their webinars

How it helps: It helps their SEO/editorial focus, their thought leadership strategy, and target industries. It helps you identify gaps in your content and inspires the category of topics one could potentially write about. Of course, the idea isn’t to regurgitate a competitor’s content but to understand how to compose something far better or identify their blind spots.

Social Media Analysis

What to gather: Engagement rates, content themes, community management, campaign performance etc.

Tools and methods to use:

LinkedIn Analytics (or Sheild Analytics app)

Sprout Social for benchmarking

RivalIQ for social analytics

Twitter advanced search

Brand24 (we use this to track competitor mentions)

Why it helps: This helps one understand their social presence, community building, and brand positioning strategy.

For example, when Notion significantly increased its presence on TikTok in 2022-2023, it revealed its intent to appeal to a younger audience and individual users.

Pricing Page & Collateral

What to gather: Pricing decks, packaging, discounting strategy, enterprise features, sales collateral

What this helps with: It helps you position yourself in terms of pricing and allows you to benchmark yourself against other players. This is critical information when it comes to negotiation phases of deals, as you’ll need a strong narrative to combat low-priced competition.

Demo Process

What to gather: The entire buying cycle, the demo flow, the qualification process, follow-up sequence, sales enablement materials

Tools & methods:

Attend competitor demos & webinars

Record sales interactions

Analyze demo environments

How it helps: Helps optimize one’s sales process and gives direction on how to identify differentiators.

So, how do you put all of this information together?

I love this template from Emily Kramer (MKT1):

Phew. Still with me? If you need a glass of water, it’s ok. I’ll wait.

OK, we figured out who to research and what tools/methods to extract information from.

But how will teams in our organization put this into action?

Let’s take a look.

Product Managers

Competitive products can accelerate a product manager’s understanding of the solution space and help them identify the baseline of solutions against which to build.

Some of the actions PMs can take are as follows:

Improving on existing solutions

Look at what features competitors' customers are praising, reverse-engineer them to find the core problem they solve, and see if your audience shares similar pain points. Ideate solutions that solve the problem more effectively.Ideating around features not present in your product

PMs can look at features that don’t exist in their product and ideate/validate if their customer base reacts positively to that. The goal isn’t to drop everything and copy. The idea is to find opportunities that hike customer value and block churn.Working on differentiators

Use competitive intel to identify overlapping features and ensure your product offers unique value. This could mean refining existing features or developing new ones that competitors don’t offer.Enhancing User Experience (UX)

Study how competitors design their user experience and identify areas where they are lacking. For example, I pay a LOT of attention to navigation design and nomenclature as that is the backbone of feature discoverability. PMs can analyze the UX to figure out ways to offer a superior user experience.Spotting Market Gaps

Competitive intel helps you see areas where competitors are not addressing customer needs or doing poorly. Use this to identify and capitalize on underserved segments or unmet market demands.

And here’s one that most miss:

Build migration guides from competitors

This goes beyond understanding APIs and technical specifics to pull relevant data in. Understanding the competitor’s product also helps PMs understand the user’s previous world and chart better journeys to onboard them effectively (especially where terminology might be different). Click up does this really well.

Product Marketing Managers

If there’s someone in the product team who can elevate their game with competitive intel, it’s PMMs.

For example, I don’t know how any PMM can work on positioning without competitive research as an input. It’s just not possible. That’s like throwing a dart at a board you can’t see.

It’s only with knowledge about product capabilities, customer opinion, market evaluation, and their reputation signals that a PMM can devise how/where a product can differentiate.

For example, here’s an example of visualizing Arc’s positioning against competition across 2 relevant aspects for web browsers:

To come up with this differentiation narrative, people at Arc would need to have studied Chrome, Edge, and Firefox at length across those attributes.

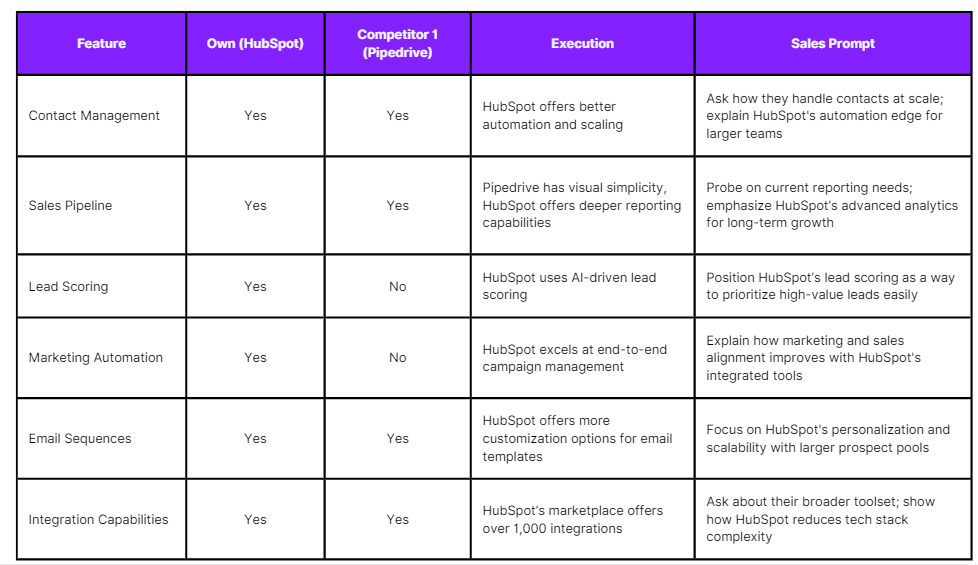

One particular artifact that PMMs deliver based on competitive intel is battle cards.

But most comparison decks aren’t that helpful, especially if they are shaped like this:

The problem with this template is that it makes the conversation very binary without giving much context for sales to work with.

The reality is that even if two competing products have the same feature, their scope, quality of execution, and design choices can be wildly different. That’s where the sales conversation needs to hinge on.

Take, for example, this spreadsheet, which compares Hubspot with Pipedrive (competitor). It not only discusses the existence of a feature but also guides on execution comparison and sales cues:

Notice how in row 2, despite accepting Pipedrive may have the visual edge in the report (of course, that’s subjective), it guides with a sales prompt suggesting how to steer the discussion.

If you’re talking about differentiation at a product-level, here’s another way to communicate it by Emily Kramer (MKT1). The “contrasting attribute” serves as your sales prompt:

Apart from this, using knowledge pools like G2, call transcription software, competitor communities, pricing sheets, enable PMMs to:

Create effective battle cards for common competitive scenarios.

Craft differentiated messaging highlighting unique benefits.

Shape go-to-market plans and adapt launch strategies to stand out in the right channels with the right messaging within a certain budget.

Develop stronger objection-handling strategies for sales to work with.

Evaluate emerging customer profiles in a competitor’s client base with high likelihood to switch.

Improve sales proposals with competitive insights.

Here are a couple of other teams that benefit:

Marketing

A marketing team would track competitor activities by Ahrefs, SEMRush, Spyfu etc. to be able to:

Identify content gaps and opportunities.

Optimize ad spend and targeting.

Choose strategic events to participate in.

Create more effective content themes.

Improve conversion optimization tactics.

Develop better lead magnets and resources.

Leadership & GTM Owners

GTM owners would look at organizational level changes, acquisitions, pricing, and packaging intel to help them:

Make informed market entry decisions.

Anticipate threat of talent-poaching.

Identify new market opportunities competitors are pursuing.

Learn about new technological advancements.

Understand the partners & resellers they are working with.

Identify more cost-efficient vendors competitors might be saving costs on.

Develop better pricing strategies to tackle objections.

Each role benefits from specific types of competitive intelligence, but the key is having a systematic process to gather, analyze, and distribute this information effectively.

Isn’t all this time-consuming?

For some odd reason, some people get riled up when I talk about competitive intelligence:

“Aatir, who in God’s green earth has the time to conduct such extensive competitive analysis? When do you do your OWN work?”

“It seems you’re asking us to leave our jobs and just analyze competitors. Do you also outsource your work to them?”

“Such obsession with competitors leaves little time for what REALLY matters: your customer’s problems.”

Yes, I’ve heard just about every variant of that.

I think people grossly overestimate how much time competitive research takes and undervalue how valuable the intel can be.

Here’s the math:

We need to analyze 3-5 players in active battle.

With all the tools I’ve mentioned, it doesn’t take more than a few hours to EXTRACT meaningful information for one competitor. And now, the time would be even shorter using AI and enterprise-grade tools.

Of course, the analysis and understanding of that data takes a bit more time.

Our Product Marketer manages to complete a competitive analysis for one provider in under 2 days (doesn’t include competitor demos, of course) for the first time.

Refreshing competitive intel takes a few hours every other quarter.

We are able to set aside roughly one week every two quarters for a Product Marketer, depending on the number of competitors entered into the active threat field.

Is it worth it?

Well, there must be a good reason why:

57% of companies surveyed by Forbes state that gaining a competitive advantage is one of the top 3 priorities in their industry AND

Gartner reports that 81% of marketers expect to be competing mostly or completely on the basis of customer experience with their competitors in two years.

Shreyas sums it up well:

Concluding word

Competitive research is an underrated tool.

If you think about it, it’s like a free library of domain-relevant ideas and potential experiments.

Granted - you don’t know what worked and didn’t work for another party. But that’s the wrong way to think about it.

Like a library, you choose the books (i.e. lessons) that are useful to you and leave the rest. The goal isn’t imitation. It’s inspiration.

And there’s no need to reinvent the wheel when a “good enough” idea already exists.

This was an interesting read, I totally agree with you on how much advantage, insights and inspiration CI gives you as a team to differentiate yourself from the rest. It helps you tell your customers why you and not your competitors.

As a PM, we definitely need to see the bigger picture and avoid copying what the competitor has done but rather learn from what they have done and find out what their customers are saying about that so either do better or do way better.

I always say that my area of specialization within the vast PMM spectrum is insights & intelligence (competitive, market, user, customer). And many get it but I've definitely had interviews in the past where people subtly imply or indicate via body language that doing CI in a PMM role is a given. This attitude is baffling to me; seeing as I've met insanely talented PMMs but maybe 1 who is strong in this arena.